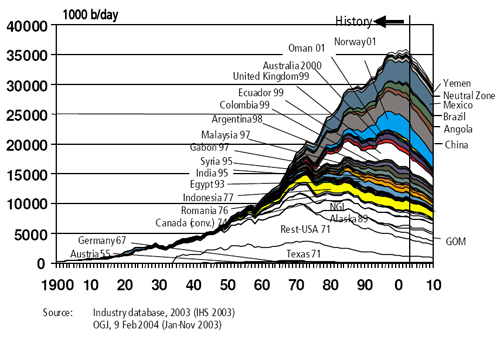

Today’s New York Times has an article about the oil industry which is interesting for its perspective. “More than 200 oil discoveries have been reported so far in 2009 in dozens of countries,” it says. These, “have totaled about 10 billion barrels in the first half of the year.”

But to put this in perspective we should remember that the production rate for 2008 (the amount extracted for use) was 24 billion barrels per year. In order to keep up with demand at today’s levels, the oil industry would HAVE to find new reserves in the amount of 24 billion barrels EACH year. To say that they’ve found 10 billion this year is only saying that they have added 5 months to the end-date of total depletion.

See the table below for a summary by country via. The total figure at the bottom in bbl/day of production is 63.5 million (x 365 days = 24 billion per year):

| Country | Reserves | Production | Reserve life 1 | ||

|---|---|---|---|---|---|

| 109 bbl | 109 m3 | 106 bbl/d | 103 m3/d | years | |

| Saudi Arabia | 267 | 42.4 | 10.2 | 1,620 | 72 |

| Canada | 179 | 28.5 | 3.3 | 520 | 149 |

| Iran | 138 | 21.9 | 4.0 | 640 | 95 |

| Iraq | 115 | 18.3 | 2.1 | 330 | 150 |

| Kuwait | 104 | 16.5 | 2.6 | 410 | 110 |

| United Arab Emirates | 98 | 15.6 | 2.9 | 460 | 93 |

| Venezuela | 87 | 13.8 | 2.7 | 430 | 88 |

| Russia | 60 | 9.5 | 9.9 | 1,570 | 17 |

| Libya | 41 | 6.5 | 1.7 | 270 | 66 |

| Nigeria | 36 | 5.7 | 2.4 | 380 | 41 |

| Kazakhstan | 30 | 4.8 | 1.4 | 220 | 59 |

| United States | 21 | 3.3 | 7.5 | 1,190 | 8 |

| China | 16 | 2.5 | 3.9 | 620 | 11 |

| Qatar | 15 | 2.4 | 0.9 | 140 | 46 |

| Algeria | 12 | 1.9 | 2.2 | 350 | 15 |

| Brazil | 12 | 1.9 | 2.3 | 370 | 14 |

| Mexico/td> | 12 | 1.9 | 3.5 | 560 | 9 |

| Total of top seventeen reserves | 1,243 | 197.6 | 63.5 | 10,100 | 54 |

|

|||||

So how did the article parse these facts?

It is normal for companies to discover billions of barrels of new oil every year, but this year’s pace is unusually brisk. New oil discoveries have totaled about 10 billion barrels in the first half of the year, according to IHS Cambridge Energy Research Associates. If discoveries continue at that pace through year-end, they are likely to reach the highest level since 2000.

If discovering just enough extra to keep up with one year’s worth of 2008 global demand is referred to as “the highest level” and “unusually brisk” then we are surely deluding ourselves. And there is no mention of whether the discoveries are “proved” or not. They may be unrecoverable, or only partially recoverable.

BP actually has a quite honest assessment of the facts on its website. They note that actually:

Global proved oil reserves in 2008 fell by 3 billion barrels to 1,258 billion barrels, with an R/P ratio of 42 years.

If BP’s own estimates are at a reserve to production ratio of 42 years, then we can be sure that they are being conservative in their numbers. We may not have but 25 years until the cost of speculation and the increased resources required for more complicated recovery make the entire system collapse under the weight of market price instability. And please keep in mind that:

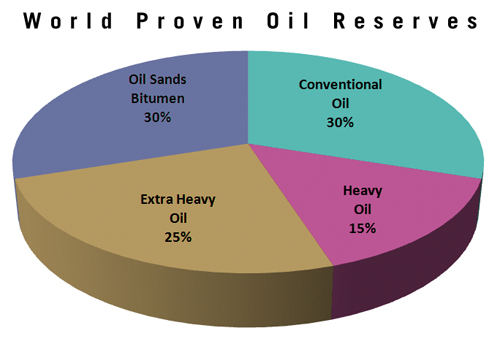

…proved reserves include an official estimate of oil sands ‘under active development’.

To include in the proved calculations reserves that will require severe ecological destruction, waste of water resources, and a cost per barrel at least twice that of conventional production is a bit self-deceiving.

Actually, if you look at the breakdown of the proved reserve types, only 30% is conventional oil. The other 70% requires more energy and natural resources to recover and will therefore be more expensive on the market.

With 1,258 billion barrels of oil proved recoverable reserves in the world, what is the value of the discovery of 10 billion more? It is less than 8/10 of one percent. By 2020 we will be using about 30 billion barrels per year, so the oil industry would have to discover three times as much each year (proven!) just to keep up. The bottom line is that the peak oil chart has not changed even a hairline. All that I’m saying is that preparing for an oil-free future that is all too close should probably not include front page coverage regarding new unproved discoveries.